Proformex provides automated notifications that are configurable and can be triggered for specific policy events. See how the team at LIBRA Insurance Partners leveraged custom notifications to generate additional new premiums and secure coverage for clients at a critical time.

Admin

Recent Posts

0 min read

Case Study: LIBRA Insurance Partners of Kansas City

By Admin on Oct 16, 2024 12:30:07 PM

0 min read

Case Study: Duncan Advisor Resources

By Admin on Aug 5, 2024 10:14:46 AM

Proformex provides automated alerts that are configurable and can be triggered for specific policy events. See how the team at Duncan Advisor Resources leveraged custom alerts to generate an additional $500k in target premium.

3 min read

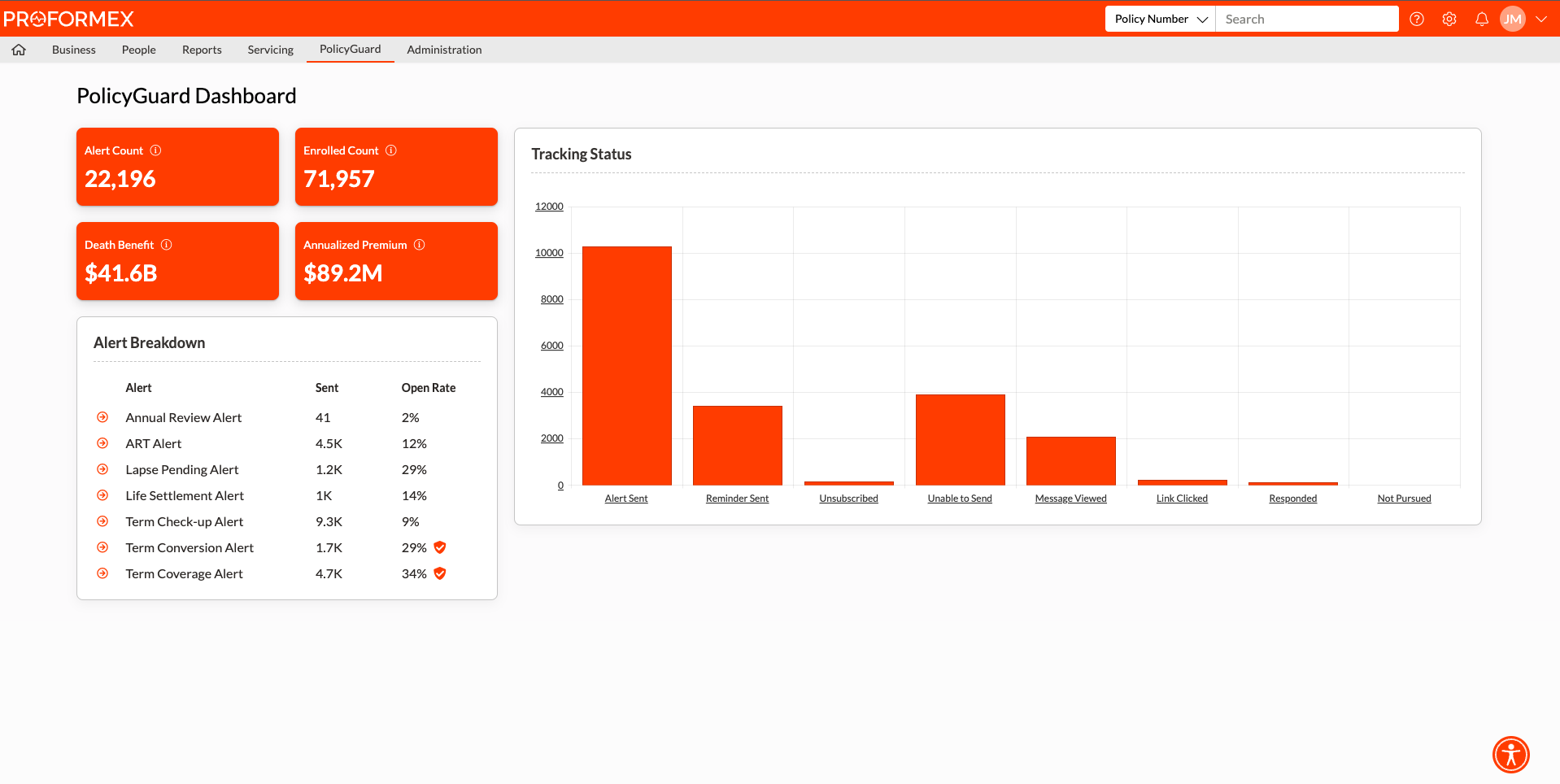

Proformex Launches PolicyGuard for Policy Event-Driven Marketing at Scale

By Admin on Nov 1, 2023 11:44:20 AM

Sizzling marketing engagement solution to activate your clients and create new opportunities to grow your business

0 min read

Case Study: The Horton Group

By Admin on Aug 30, 2023 5:45:00 AM

Insurance professionals deserve better tools and technology to help them manage their life insurance business. Paul Shaheen, a 30+ year veteran of The Horton Group, uses Proformex as his solution to this industry-wide problem.

In the case study below, you'll read more about how he uses Proformex to take his client outreach to the next level. Check it out!

0 min read

Using Proformex for Better Client Management and More Accurate Succession Planning for Your Insurance Business

By Admin on Aug 16, 2023 1:21:29 PM

In the webcast video below, Scott Cahill, Senior Vice President of Fulcrum Partners, talks about how having a single system of record for your life insurance policies helps to institutionalize your book of business, leading to much more efficient and effective succession planning when the time comes to transition out of your practice. Give it a listen!

1 min read

Case Study: Fulcrum Partners

By Admin on Aug 14, 2023 11:47:14 AM

The team at Fulcrum Partners uses Proformex to better manage their clients' life insurance policies. With our post-sale client management tool for life insurance, they're able to stay ahead of any policy risks or new sales opportunities. Additionally, using Proformex allows their team to have centralized visibility of their assets in one place, which will help provide an accurate value on the book when it comes time to consider succession planning for their business.

Read more about the success they've had using our platform in the case study below!

1 min read

Case Study: Wiseman & Associates Wealth Management

By Admin on Aug 14, 2023 11:41:47 AM

The team at Wiseman & Associates Wealth Management uses Proformex to proactively identify potential policy risks and new sales opportunities in their life insurance business. While life insurance isn't a primary focus of their business, they do believe it's an important asset to properly manage over a client's lifetime to ensure the coverage continues to meet its intended objectives relative to the client's overall wealth management plan.

Read more about the success they've had using our platform in the case study below!

0 min read

Making post-sale policy and client management a more efficient and profitable activity

By Admin on Aug 10, 2023 11:52:55 AM

Simplicity Keystone (fka Keystone Benefits Group of Atlanta) is an executive benefits consulting group offering tailored solutions to some of the nation’s largest financial, accounting, actuarial, and employee benefit consulting firms. Their team was looking for a better way to manage the life insurance policies within their clients' portfolios and found Proformex to be just the solution they needed to make servicing those policies a more efficient and profitable endeavor.

Hear what Michael Falkenstein, Partner, has to say about his experience using Proformex in the video below!

0 min read

Proactively Identifying Policy Risks and Client Service Opportunities with Proformex

By Admin on Aug 3, 2023 10:11:30 AM

Tom Wiseman & Reid Turnure of Wiseman & Associates Wealth Management share how they use Proformex's post-sale policy management and engagement tool to stay ahead of risks and opportunities among the life insurance policies in their portfolio. By staying proactive with cases that need attention, they're able to ensure life insurance doesn't become a forgotten asset and gets the attention it needs to keep the broader client relationships strong, which in turn keeps their wealth management firm's reputation strong. Give their testimonial a listen below!

0 min read

Multi-carrier visibility of clients' life insurance policies for better post-sale servicing

By Admin on Jul 27, 2023 5:45:00 AM

MG&A Wealth is a wealth management firm who uses Proformex to manage the life and annuity assets within their business. Through Proformex, they're able to get multi-carrier visibility on all their clients' policies and contracts from a single login. Our platform makes it easier than ever for them to actively manage these assets and stay ahead of any potential risks or opportunities to cross-sell, upsell, or resell to existing clients.

Hear more about their experience with the platform and an example of a win generated by Proformex in the video below!